About the Client

A leading global transfer pricing consultant serving a diverse set of industries, including financial services, manufacturing, retail, energy, pharmaceutical, technology and entertainment

Challenge

Lack of credit risk and benchmarking data for private borrowers

Tax authorities emphasize the need to consider the risk profile and credit quality of the borrowing subsidiary when assigning market interest rates to intercompany loans. However, doing so for a subsidiary or new venture that doesn’t borrow from public markets is challenging. Acquiring benchmark pricing data for a specific transaction date requires extensive research and specialized default data. Additionally, transparent and well-documented analysis of the transfer price are critical for OECD (Organisation for Cooperation and Economic Development) compliance.

Solution

Innovative approach provided unparalleled data insights and transparency

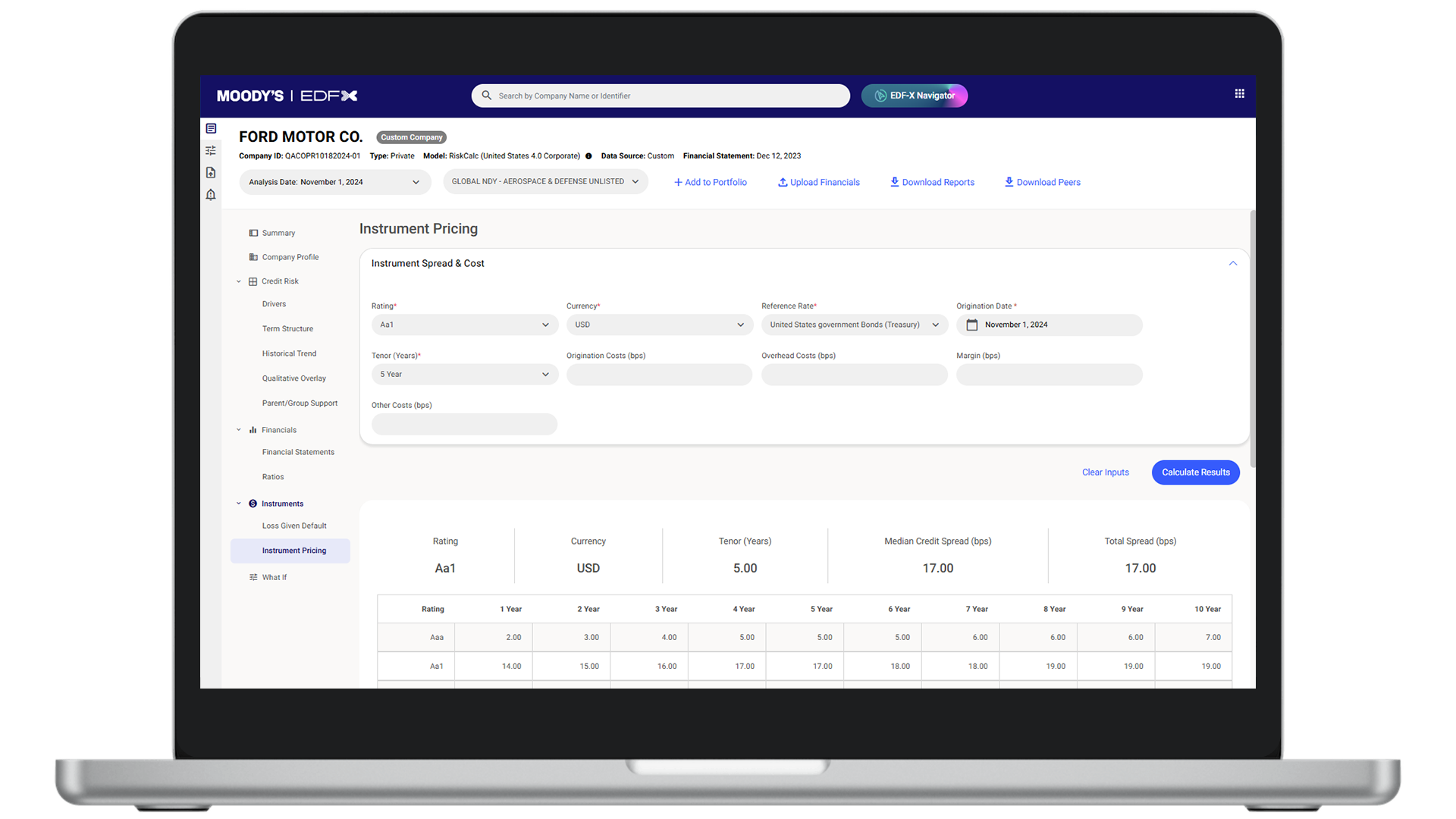

With limited information on private borrowers, it was challenging for the client to accurately evaluate credit worthiness and set the appropriate interest rates per OECD guidelines. Moody’s provided an objective, quantitative credit risk assessment model to determine probability of default (PD) and implied ratings for subsidiaries across countries and industries. The client also tapped into our financial transaction data for arm’s length benchmarking, making appropriate economic adjustments to control for differences between the terms and conditions of the intercompany loan and the market-based pricing data. The output was also used to justify the economic substance of the transaction conditions and analysis to tax authorities.

EDF-X turned the value of our data into action for the client

Complying with regulations and avoiding financial risks can be a daunting task. Moody’s made it easier for the client to accurately determine credit risk scores and market interest rates for intercompany loans—resulting in informed decision making in their transfer pricing analysis. Here’s what the client did to enhance their transfer pricing process for private borrowers.

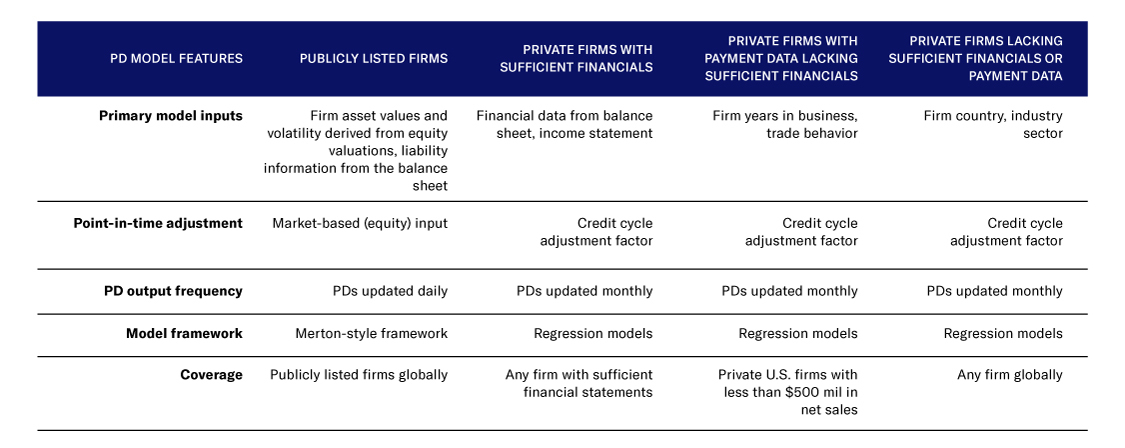

Clear methodology for transfer pricing documentation

Although Moody’s PD models are derived using different data inputs and different modeling methods, the models all yield forward-looking, point-in-time probabilities of default. They are updated monthly or daily and serve as a solid foundation for potential future financial insights that may impact a company’s credit risk.

How it works?

Actional insights for 520+ million companies globally

Moody’s transfer pricing capabilities consider standalone company credit risk, presence of implicit support, qualitative factors and median credit spreads, with the option to further benchmark different transactions by industry, geography, asset class, credit risk, and more.

Key benefits to the client

Game-changing automation and efficiencies provided a results-driven approach

Impact

Implemented best-practice credit assessment and benchmarking tools

The client confirmed that the data and insights Moody’s offered allowed them to assess company credit risk faster and determine interest rates of intercompany loans that aligned with OECD transfer pricing guidelines. This approach has saved their team time and money and helped differentiate tax strategies to regulators. The client’s clients confirmed that they have been able to mitigate financial penalties, double taxation, and damage to reputation from this enhanced output.

What the client said

"We are not in the credit rating business. Moody’s makes our job easier because we can point to their results and let tax authorities know that this implied credit rating came from a reputable firm that specializes in credit risk assessment."

– Manager, Transfer Pricing Practice